DIGITAL ID - Chapter Five (Why are cryptocurrencies controversial?)

This is the second of a series of articles prepared by the ReformUK Community on X.com with a similar structure & presentation to help UK youngsters aged 16+ and adults choose who to vote for...

DIGITAL ID - Chapter Five

Because of the importance and general lack of understanding of this topic, this document is more of a book primarily concerned with Digital ID in the UK that also covers other subject areas in summary which are relevant to the extent that Digital ID may be used in ownership of assets such as bank accounts, fiat & digital currency, cryptocurrencies, taxation, personal identification, international border control and general surveillance of increasing populations in an increasingly global world open to many digital opportunities, concerns and challenges to our lives, freedoms, wealth and livelihoods.

Political parties are increasingly talking about Digital ID and some high risk steps may be irreversible. Decisions enforced by UK Law will be dependent on Parliament, on what our MPs decide, on the policies of UK Political Parties and thus on who we all vote for…

The content is presented in SIX CHAPTERS:-

CHAPTER ONE - Why is Digital ID the next logical step in our increasingly digital world?

CHAPTER TWO - How is wealth changing and what is valuable in life?

CHAPTER THREE - What is Digital ID?

CHAPTER FOUR - Why is Digital ID controversial?

CHAPTER FIVE - Why are cryptocurrencies controversial?

CHAPTER SIX - What are the present policies of UK Political Parties in regard to Digital ID and currency usage into the future?

These chapters are first going to be released separately through the ReformUK Community on X.com, with a link to the complete document for those who want to read it like a whole book.

CHAPTER FIVE

Why are cryptocurrencies controversial?

SUMMARY OF CRYPTOCURRENCY CONCERNS

A Finance Bill in support of cryptocurrency use may help in the London & other Financial Districts, but is also competition to normal banks & independent of Digital ID. The Bank of England can currently use Base Interest Rates & Quantitative Easing to help control UK inflation; which cryptocurrency by-passes.

A future UK Government could potentially mandate Digital ID and CBDC usage, banning private holdings and usage of cryptocurrencies such as Bitcoin. About 3 million Bitcoins have already been lost through forgotten wallet details, lost hard drives & death of investors. None can be added beyond those mined.

Near term UK Strategic Wealth Fund purchases of Bitcoin may be profitable if the price to buy a Bitcoin continues to increase, but the risks remain significant.

For various reasons, the Bitcoin price has crashed badly several times in the past, and this could easily happen again for technical & support reasons, fraud, political concerns and buyer disinterest in fear of financial loss once there are very few Bitcoins left to mine. There are other risks involved in the maintenance of Bitcoin blockchains which are covered in this publication: masterthecrypto.com.

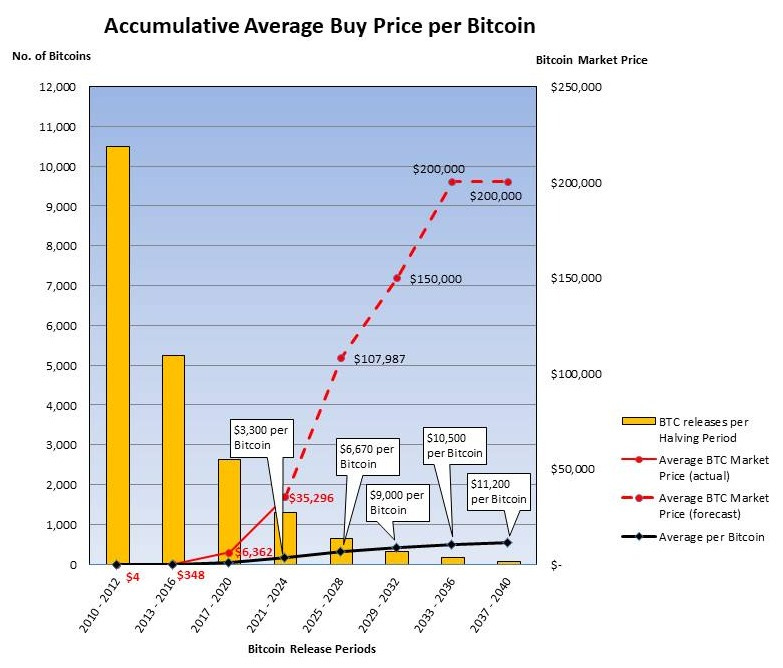

Swan Bitcoin Pundits & economists (bullish on the marketing side) predict the price of a Bitcoin could stabilise near $1m (Chamath Palihapitiya), possibly much higher with Bitcoin ETFs (Exchange-Traded Funds) and if trading, usage & numbers of buyers of bits of Bitcoin continue to grow through to 2040 and beyond, especially in the Strategic Reserves of Countries. However, if we assume pricing of $100,000 per Bitcoin in 2025 to 2028, $150,000 from 2029 to 2032, and $200,000 from 2033 onward during the period the last one million Bitcoins are mined, that will give an average price actually paid for the overall total of 21 million Bitcoins, progressively mined, of about $11,200 USD per BTC. This excludes profit taken by original buyers on their own Bitcoin sales (some of which was spent on adding more secure cryptocurrency infrastructure for purchase, trade & other exchange capability, e.g. Binance) – compared to the 12th September 2025 market price of c.$115,000 per whole Bitcoin, a factor x10.

The following graph shows how the market price of Bitcoins has risen since release at the end of 2009 compared to the actual average price paid for those Bitcoins when first released, per halving period and on an accumulative basis up to the $11,200 estimate per BTC for the max. 21 million Bitcoins, with 1 million left to be released:

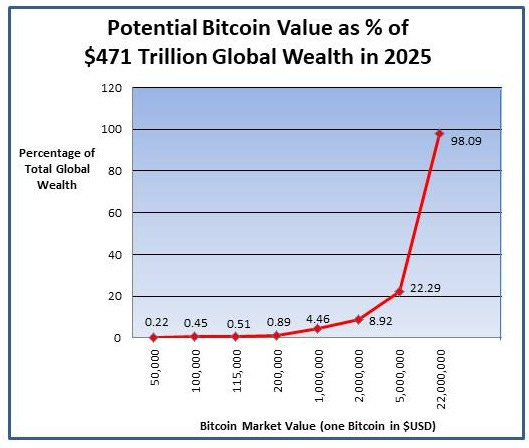

Forecast Bitcoin prices beyond today could potentially be anywhere between zero (post a major price crash for any reason - political, war, financial crash or technical/fraud issues) and £22 million in a scenario where the collective value of Bitcoin might align with the total wealth of the world. The following chart shows the Total Bitcoin value in various scenarios as a percentage of Total Global Wealth reported to be nearing $471 Trillion in 2025, provided by Forbes sourced through the 2025 UBS Global Wealth Report.

Conflicts could also grow on the true value of a Bitcoin because by the time mining ends, and they are all sold into private & government hands, the total market value of the total 21 million Bitcoins could easily exceed $4 Trillion at just a $200,000 price, and be close to $471 Trillion should the market price per Bitcoin reach $22 million in the scenario that Bitcoin becomes the single world currency - which is most unlikely.

With the Dollar Average actual buy price per Bitcoin since first release in 2009 expected to be about $11,200, compared to bullish predictions of market values of $1m to, say, $5m a Bitcoin by 2040, the profit multiple for earlier Bitcoin buyers could then be between x90 & x450 – even though there are no tangible assets (e.g. gold, land, property) underwriting the Bitcoins excepting the limited exposure of its management companies, holding, trading and usage infrastructure.

When the Market Value of Bitcoin is very high (as it already is to some extent), unsupported by tangible assets, it may not be politically expedient of the International Monetary Fund (IMF), governments world-wide and the Bank of England to accept Bitcoin values in normal day-to-day shopping, trading, house purchase, etc. as the equal of fiat money, e.g. the current GBP or possible UK Digital Pound, which governments under-write with treasury and other assets, with “promises to pay”.

Stabilisation of Bitcoin market prices nearer $100,000 per BTC may be more generally acceptable, but it will all depend on market forces and politics. China have already banned private holdings of cryptocurrencies like Bitcoin. Some businesses are accepting Bitcoin to increase their own holdings whilst current owners can crystalise their profits when buying other assets (e.g. expensive watches or jewellery, etc.) whilst the potential for increases in Bitcoin Market Value is indeterminate longer term.

Nevertheless, for example, Venezuela’s crypto and stablecoin adoption has surged in corner shops to big retailers as inflation soars and the bolívar lost over 70% of its value since May 2024. The longer term outcome is far from certain; but shows the danger when a Country’s fiat currency is not kept strong in global markets.

It is also worth noting the minimum Bitcoin transaction adjustment, e.g. to price or buy goods, is one millionth of a Bitcoin, which might restrict usage, i.e.

$100,000 = 10 cents, $200,000 = 20 cents, $1,000,0000 = £1, $5,000,000 = $5.

Overall, the future for Bitcoin and other cryptocurrencies is far from certain…

DIGITAL ID - GLOBAL INITIATIVES

There are numerous initiatives ongoing and planned at present which have some tie in or requirement for Digital ID, some of which may have far-reaching consequences. At this stage it is impossible to fully know what might be done under the headings of UN Agenda 2030, Big Tech, CBDC, AI, Great Reset, Fast Payment mechanisms, Space Economy, Surveillance, etc. and how these might interoperate. The Sociable is one Technology News Publication whose articles cover some of those issues, for those wanting to read more on such topics.

END OF CHAPTER FIVE

Articles produced by the ReformUK Community

Direct access links to the latest full publication issues are given below:-

Digital ID (complete document, chapters one to six)

Thanks for reading these publications. Subscribe for free to receive new posts and support my work.

Disclaimer: The information provided herein is for general informational purposes only. The ReformUK Community on X.com assumes no responsibility for errors or omissions in the content or for any actions taken based on the information provided. Information is provided for your interest, study and further research without the endorsement of any organisation or political party mentioned. The ReformUK Community is not responsible for the accuracy, reliability, or content of any of the source Social Media, third-party websites. Use of this material is at your own risk, the author’s and the ‘ReformUK Community’ are not liable for any damages arising from its use.